Key Takeaways:

- Fantom coin rallies 180% YTD.

- FTM/USD broke out of a falling wedge,reaching the target.

- Fantom on-chain metrics bullish in the long haul.

YEREVAN (CoinChapter.com) – Fantom (FTM) outshines its competitors making the 6th largest monthly progress of over 165%. Moreover, the digital asset added another 20% to its value in the previous 48 hours, bringing the year-to-date progress to 180%, as the FTM/USD exchange rate stood at $0.56 on Feb 2. Thus, a closer look at the Fantom charts is warranted.

FTM token met and surpassed the falling wedge target

The FTM token traded within a formation named the ‘falling wedge’ since May 2022. The latter featured two converging trendlines with a negative slope that enclosed the fluctuations, incrementally driving the FTM price lower.

Notably, the falling wedge is a bullish reversal pattern that foresees a sharp ascend, equal to the wedge’s maximal height, once the digital asset exhausts the formation. FTM indeed broke above the wedge’s resistance on Jan 5, confirming the setup and reaching the target of $0.49.

Fantom target still bullish

The bullish incentive could continue further despite FTM reaching its falling wedge target. The daily chart’s consistent trading volumes testified to the traders’ continuous interest. Thus, the next target for Fantom could stand at a former resistance of $0.64, a 13% price advancement.

If a setback occurs, the Fantom coin could stop back to $0.55, retesting the level as support. However, the possible correction does not contradict the bullish prognosis. Additionally, the on-chain metrics on the Fantom Network back the optimistic outlook.

Fantom on-chain metrics bullish

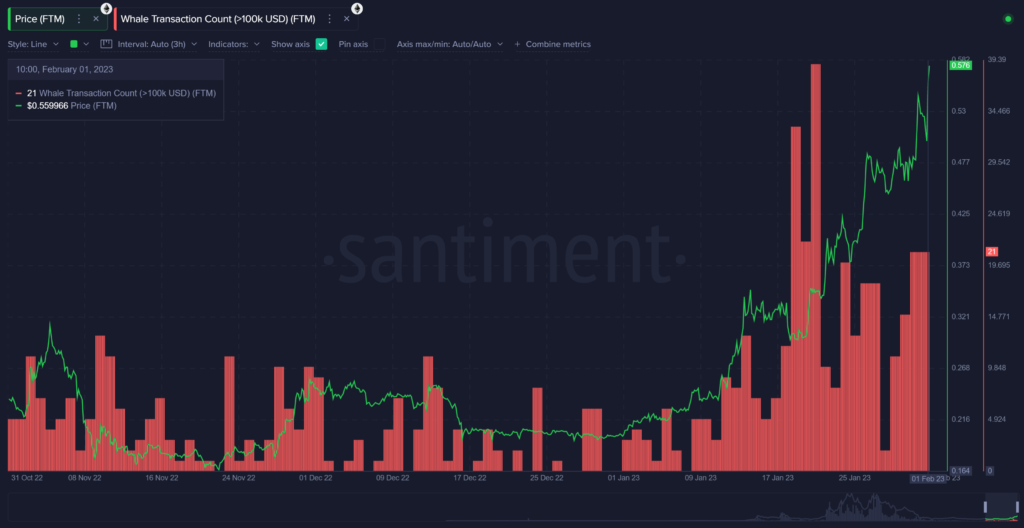

Crypto analytical platform Santiment conducted a report on Fantom, noting several bullish parameters that could support a further rally. “The dormant coin movement & rising whale transactions are good long-term signs,” noted the platform.

Firstly, the platform confirmed the steady trading volumes noted in the technical analysis above, posting a chart to back it up.

This rally still has some legs in the fact that its mean dollar invested age, which measures the average age of investment for Fantom, dipped considerably lower during the second half of February. This is a great sign that dormant coins have been moving at a healthy pace into this price rise:

also commented Santiment.

Moreover, Santiment also noted that the number of whale transactions considerably grew in January, with a “sudden massive peak” on Jan 18-19, during a price dip. The whale accumulation continued with a heightened pace since, fueling bullish hopes.

One could argue that the transaction count by itself does not specify an accumulation. However, the fact that the number peaks during stalls and drops during surges underscores the incentive to hold. Otherwise, the whales would also sell at the high.

All the on-chain metrics mentioned above concur with the possibility of another leg up in the upcoming sessions. However, it is important to note that fantom, like many other altcoins, depends on the overall market climate. Should the US economy fall into recession, Bitcoin will likely follow, dragging the altcoin market along for the ride. Thus, traders shouldn’t rely on an FTM solo rally.