image from bonasystems.com

image from bonasystems.com

Introduction

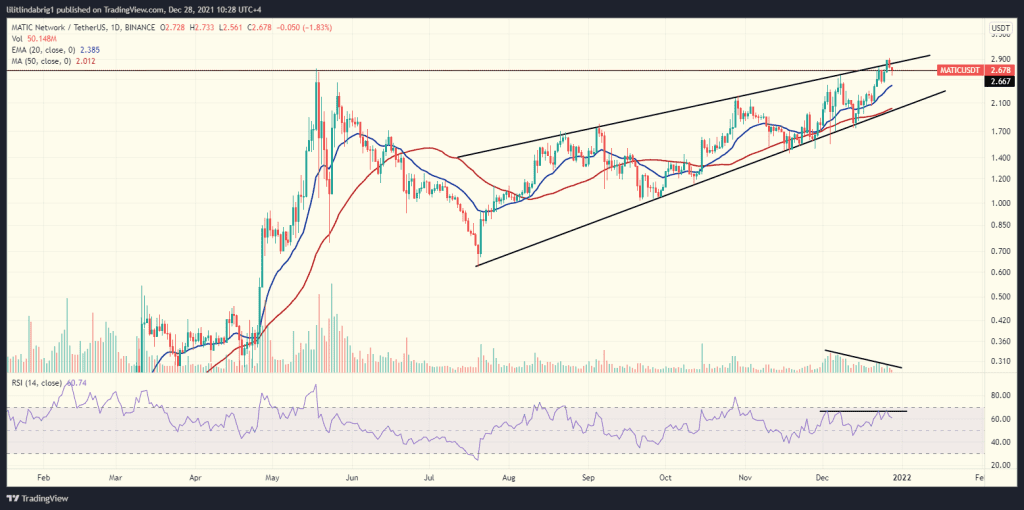

Polygon has seen its share price rise steadily in recent weeks. The company hit a new all-time high on December 27 at $2.92 before correcting downwards to $2.69 on Tuesday’s session

Key Takeaways:

- Polygon, the protocol for building and connecting Ethereum-compatible blockchain networks, rallied 60% in the previous two weeks, but couldn’t hold the level for long, correcting 7.5% since Dec 27.

- Its native token MATIC flashed bearish warnings on the daily price chart.

- Polygon’s December collaborations could save the day.

YEREVAN (CoinChapter.com) – Polygon’s fruitful two weeks run took it to a new all-time high of $2.92 on Dec 27. However, the rally halted shortly after, and MATIC lost bullish momentum, correcting down to $2.69 in the Tuesday session. The digital asset kept significant support at the previous high of $2.66 but flashed a constellation of bearish technicals.

Bearish signs for MATIC

Polygon traded in a Rising Wedge formation since late July. The latter entails two converging trendlines with a rising slope that push the value higher while lowering the price swing. However, the Rising Wedge is a bearish formation that could result in a downtrend once MATIC exhausts the pattern.

The price action retested the Wedge’s resistance several times in the previous months, and the latest all-time high outside the pattern wasn’t a convincing breakout. If the token fails to hold the 2.66 support, it could fall to the Wedge’s lower trendline and hit $2.14, an approximately 20% fall from the current value.

Additionally, Polygon registered a trading volume divergence on the daily chart. The latter occurs when the price action prints higher lows, but the trading volume declines. The deviation predicts a looming downtrend. Moreover, the relative strength index (RSI) did not quite follow the price action either.

In hindsight, the RSI is a momentum indicator that reflects the traders’ perception of a token’s return capability. If the price action registers higher highs, the RSI often follows suit. However, a bearish divergence could occur when the RSI prints lower highs instead of mimicking the price action.

MATIC did not actually see an RSI divergence, as the highs came in at seemingly the same level. But a closer look at the four-hour chart did reveal a deviation, which could lead to a temporary setback, confirming the Falling-wedge’s prediction.

Also read: MATIC prices react to Polygon’s “burning” news to recover from Monday’s 13% fall.

Polygon has had a successful month overall despite the bearish technicals, scoring several key partnerships. The latest addition to the Polygon Network was Uniswap, the largest decentralized exchange (DEX) with over $1.5 billion worth of daily transactions.

Uniswap launched on Polygon

Both companies announced the news on Dec 23. Since then, both UNI and MATIC have gained over 30%. The deployment came after Uniswap users voted to pass a governance proposal on the matter.

Mihailo Bjelic, the co-founder of Polygon, voiced his point of view on the deployment and why Uniswap chose Polygon over Ethereum.

Ethereum introduced a noble vision of an open, borderless economic system accessible to everyone. With the increased usage, fees on Ethereum layer 1 have effectively ‘priced out’ most of the users. With this deployment, Uniswap as the flagship Ethereum application returns back to the original vision and again offers low fees and open access to everyone.

asserted the executive.

Moreover, Polygon’s scalability, efficient processing times, and low gas fees strengthen the Network’s position as an ‘Ethereum killer,’ says another co-founder, Sandeep Nailwal.

From the Polygon Scan Explorer, you can see that the average block time is around 2.3 seconds. As for Ethereum, that is 15 seconds. And then the gas fees, you can see 0.001 MATIC tokens; this is a point fraction of a penny.

He commented recently.

Mr. Nailwal also pointed out that close to 5,000 development teams work on the Network. Moreover, according to the executive, Polygon has 50% more daily users than Ethereum, and the booming NFT industry could take the Network even further.

Also read: Polygon acquires Mir Protocol for $400M to expand its scaling solutions.

The growing Polygon adoption and the expanding DeFi and gaming sectors could benefit MATIC in 2022, taking the token to new ATHs. However, the technicals foresee a short-term decline coming up. The upcoming sessions will show if the digital asset can hold the $2.66 support, which might prove crucial in determining its future bias.

Rate my Post Plugin