Today, the need for a good decentralized storage project has never been stronger. Such a project needs to ensure that our data is safe and immutable. To add on, online file storage places heavy loads on blockchains. Hence, a good storage blockchain needs to have the technology to handle such loads. With this, we look at the many projects tackling this problem, and how they compare against each other.

An In-Depth Look Into Decentralized Storage

The general idea behind most decentralized storage projects is:

- Firstly, users submit their data online for storage. The storage project then encrypts the received data. This ensures only the user can access the submitted data. In some instances, the data is divided into smaller parts for distribution through a process known as sharding.

- Next, the data is stored across different locations, made up of free disk space from storage providers. Usually, they share their free disk space to earn a reward.

- Lastly, the blockchain records the information of the storage transaction. Hence, the network can “remember” where the file was stored, along with other important details.

The end goal is to create a peer-to-peer (P2P) ecosystem, which connects users and storage providers directly.

Decentralized Storage Landscape – Top Projects in 2022

The top projects in the decentralized storage landscape are:

- Filecoin

- Crust Network

- SIA Network

- Arweave

- Storj

Essentially, all of the above projects have the same goal. First, they must ensure stored data is always accessible while being secure and immutable. Next, they must build a thriving P2P ecosystem. Lastly, the blockchain which facilitates the data storage must be decentralized and scalable.

Yet, each project has its own approach to achieving said goal. Now, let’s look at each project and learn what makes each one of them unique.

1) Filecoin ($FIL)

Filecoin is a decentralized file storage network. It is also a P2P sharing network. Filecoin was built on top of the Interplanetary File System (IPFS).

Filecoin’s Design

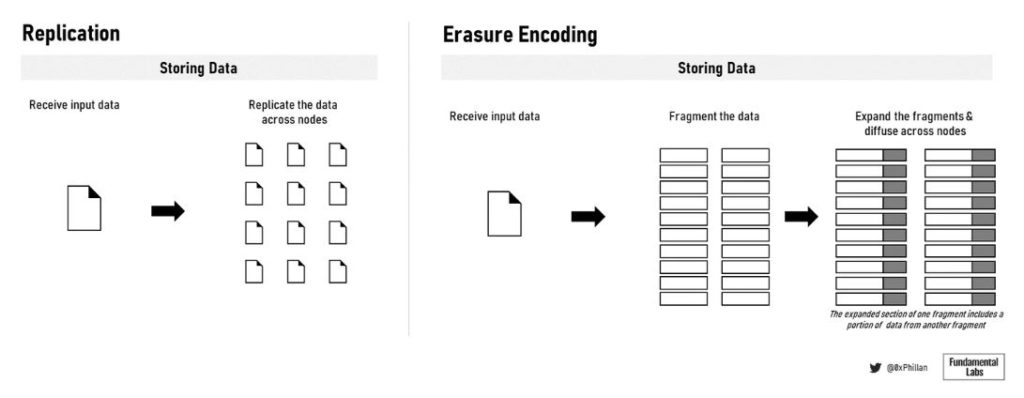

In terms of design, Filecoin uses a method of storage known as erasure encoding. Simply put, this takes deposited files and fragments them into smaller pieces. Then, these fragments are encoded by adding “redundant” data. Next, said fragments are distributed across the Filecoin network. Below is a visual aid showing how erasure encoding works, compared with typical replication of data (I.E Storing of similar file copies across nodes).

Let’s say nodes that store file fragments leave the Filecoin network. Wouldn’t the deposited files be lost? To mitigate this, projects need to have high data redundancy. There are many ways to achieve this. For Filecoin, they’ve implemented a storage fragment threshold. Filecoin re-introduces the storage command to prevent full data loss once this threshold breaks. Note that the higher the data redundancy, the longer the data can stay preserved in the network.

Next, the network must be able to reproduce the files once users request it. To achieve this, Filecoin uses its own native blockchain to track storage locations. Filecoin also incentivizes nodes to retrieve data. This is needed because retrieving data comes at a cost through bandwidth. They use a payment mechanism to allow users to pay nodes directly for the service.

For more in-depth analysis, the report here from Fundamental Labs delves into detail on the above concepts.

$FIL Coin

Some of $FIL’s uses include:

- As a reward for storage providers.

- For rights to access the network.

For its tokenomics, $FIL has a fixed max supply of 1,968 million coins. Also, it has a circulating supply of 227 million coins. It’s trading at $5.30.

A portion of $FIL is burned as fees are incurred. Hence, this reduces the max supply of the coin. Storage providers also lock up $FIL as pledge collateral. In turn, this reduces the circulating supply of the coin.

Despite the above, $FIL is an inflationary token. This is due to its dual minting model. You can read more about how $FIL emissions are designed here.

2) Crust Network ($CRU)

Crust Network is a decentralized storage and computing application. To understand more, you can refer to our previous research here.

Crust’s Design

In terms of design, Crust uses data replication instead of erasure encoding. Simply put, the network replicates deposited files and distributes them across storage locations.

However, Crust has not yet developed a mechanism to ensure high data redundancy. In other words, as nodes leave the ecosystem, so will the data stored in these nodes. In turn, this means data stored on Crust has lower permanence, compared to other projects. This is a weakness as Crust is a project that allows nodes’ free entry and exit.

Crust uses its native blockchain to track storage locations to reproduce requested files. Crust also incentivizes nodes to facilitate file withdrawals as well. They do this through a tracking system, which looks at node traffic. Nodes that do not facilitate file withdrawals frequently will receive fewer storage orders.

$CRU Coin

Some of $CRU’s uses include:

- Staking and Governance.

- Payments for transaction fees.

- Buying of services.

- Serves as a reward for storage providers.

For its tokenomics, $CRU does not have a fixed max supply. Today, its total supply is at 20 million coins. Also, it has a circulating supply of 3.6 million coins. It’s trading at 80 cents.

In addition, you would need to lock up $CRU coins to participate in node selection. In turn, this reduces the circulating supply of the coin. Despite this, $CRU is an inflationary token. This is because staking participants receive $CRU emissions as rewards.

3) SIA ($SC)

SIA is a decentralized data storage application. It aims to create a trustless cloud storage marketplace. It is one of the oldest projects in crypto, with its inception dating to 2013. SIA also emphasizes privacy. Hence, nodes storing the data do not have access to the data which they store.

SIA’s Design

In terms of design, SIA uses erasure encoding for its storage method. Deposited files are also fragmented and stored across different storage locations on the SIA network. This is similar to Filecoin’s method of storage.

To achieve high data redundancy, the SIA network looks out for missing pieces of data. Once found, the network then rebuilds the data found and re-encodes the file. Then, they fragment the file again to restore the missing pieces of data. To do this, users have to log into the SIA platform. Hence, this may not be user-friendly compared to other projects.

To reproduce requested files, SIA uses its own native blockchain to track storage locations. SIA uses a payment mechanism to incentivize nodes to facilitate file withdrawals to allow users to pay nodes directly for the service.

$SC Coin

Some of $SC’s uses include:

- Paying for storage.

- Serving as a reward for storage providers.

- Serving as a reward for SIAfund owners. This is the network revenue-sharing token for SIA network.

- Acting as a medium of collateral for storage providers.

For its tokenomics, $SC does not have a fixed max supply. Today, both its total and circulating supply are at 51 billion coins. It’s trading at $.003 (.3 cents).

SIA is developing a proof of burn mechanism. This is for nodes to prove that they’re active and real participants. Nodes have to burn 4% of their $SC coins. This reduces the circulating supply of the coin. However, the total supply is always inflating. This is because $SC coins are distributed to SIAfund owners.

4) Arweave ($AR)

Arweave is a protocol that allows permanent data storage. It aims to become a P2P ecosystem linking users and storage providers. Arweave has an application built on it, called the Permaweb, used for preserving web pages and protocols.

Arweave’s Design

In terms of design, Arweave uses data replication as its storage method. As a user deposits a file, Arweave makes copies of it and distributes them to different storage locations in the network.

To achieve high data redundancy, Arweave uses a proof of access algorithm. This allows data stored on Arweave to be consistently replicated. This effective method increases data permanence, which defines Arweave’s main selling point.

To reproduce requested files, Arweave uses a “blockweave” to track storage locations. Arweave uses a tracking system called Wildfire to incentivize nodes to facilitate file withdrawals. This ranks nodes based on performance. Nodes that fall short are banned from the Arweave network itself.

$AR Coin

Some of $AR’s uses include:

- Paying for storage.

- Serving as a reward for storage providers.

For its tokenomics, $AR has a fixed max supply of 66 million coins. Today, its total supply is at 64.6 million coins. Its circulating supply is at 50.1 million coins. It’s trading at $10.19.

Arweave has an endowment-style policy for its network. This locks up $AR coins so that interest generated can pay for future storage costs. This is good as it removes $AR coins from the circulating supply.

5) STORJ ($STORJ)

Storj provides a service known as Decentralized Cloud Storage (DCS). DCS aims to provide permissionless file storage while focusing on privacy and security.

Storj’s Design

In terms of design, DCS uses erasure encoding as its storage method. Deposited files are fragmented and stored across multiple nodes on the DCS network.

To achieve high data redundancy, DCS uses Satellite nodes on their network. Its purpose is to run data audits to ensure missing fragments are continuously replenished. Hence, this allows files on DCS to have a high permanence.

To reproduce requested files, DCS also uses Satellite nodes. They coordinate between storage nodes and users to ensure storage locations are defined. In this case, Storj differs from all other projects above, as they use blockchains instead. DCS uses a payment mechanism to incentivize nodes to facilitate file withdrawals to allow users to pay nodes directly for the service.

$STORJ Token

Some of $STORJ’s uses include:

- Paying for storage.

- Serving as a reward for storage providers.

- Serving as a medium of exchange for Satellite nodes.

For its tokenomics, $STORJ does not have a fixed max supply. Today, its total supply is at 425 million tokens. Its circulating supply is at 144 million tokens. It’s trading at 66 cents.

Comparison of the 5 Projects

With the above analysis, we believe each project has its pros and cons. From the user’s standpoint, some projects will suit your needs better than others. From the investor’s standpoint, some projects do have better tokenomics. However, we need to look at the project’s adoption moving forward.

To summarize:

- Filecoin’s focus is in onboarding storage providers. With its large coin supply and dual minting emissions, Filecoin aims to expand its storage space. However, it may not provide the best incentives for nodes to process file withdrawals. As an investor, I would consider the high inflation of the token.

- Crust has a proven system of incentivizing nodes for file withdrawals. However, it does not have good data permanence due to lack of a replenishment mechanism. As a user, I would consider using it for smart contract dApps instead.

- SIA’s focus is on privacy. This is suitable for users valuing privacy of their data. As an investor, a concern would be the high allocation of SIAfunds to the SIA core team.

- Arweave’s main selling point is permanence. This is suitable for users who want to store data for centuries. NFTs would be a great use case. Also, it has a fixed max supply for $AR coins. As an investor, this means a cap in $AR’s inflaton.

- Storj also has good data permanence with its data audits. However, there could be concerns about centralization. This is because there are only 6 satellite nodes that maintain the DCS. You can view them over here.

For a greater in-depth look at the decentralized storage projects of today, you can check out the tweet thread below by Fudamental Labs

Conclusion

To conclude, it seems there isn’t a clear winner yet in today’s decentralized storage space. Indeed, it could be best for users if many projects’re existing together, each for a specific purpose. Only the future can tell which projects will gain the most adoption.

Trending posts: Which altcoins will survive the BEAR market? | Crypto Tokens With Big Return 2022 | Kaspa Wallet | Features, types, how to send & receive funds

Trending reviews: Infinity Wallet Review | Ethos Coin & Wallet Review | ETHLend Review | Switchere Review | Trezor Wallet Review | Ledger Wallet Review | KeepKey Wallet Review

Follow Verge Hunter on: Twitter | Facebook Page | Facebook Group | LinkedIn | Google News